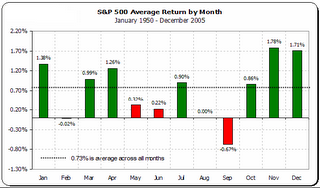

Reversion to the Mean?

Second, this brings up a behavioral bias point. In the March-April 2006 issue of CFA magazine, Roger Mitchell states, ". . . whereas most people are prone to hot-hand fallacy (undue confidence that a recent trend will continue), professional investors are prone to gambler's fallacy (undue confidence that a trend will revert to the mean). It seems that specialized training can alter people's tendencies." In our experience, there are at least as many, and probably more professionals who fall into the hot-hand fallacy category, but the point is taken. We at times have been too early as contrarians and have had to suffer through some troughs that turned out to be longer and wider than originally anticipated. Still - we continue to believe that if you are not willing to be contrarian, or more specifically, contrarian with a catalyst scenario, you ought not to be trying to adjust sector weights in a portfolio. It won't work in the long run.