September Trends

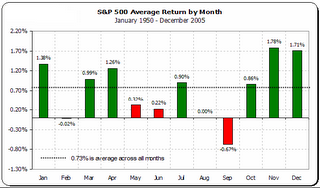

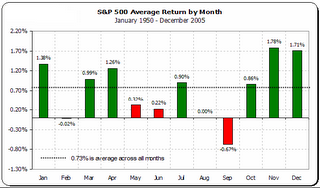

We're now into September and typically only the few days leading up to Labor Day experience positive returns in the equity markets - the balance of the month tends to be poor performing.

There are a lot of reasons for this. We think one of the main reasons is that most mutual fund's fiscal years end at the end of October. The stock market often trades in a seasonal pattern where the best returns occur from mid/late October through April of the following year. The past year was no exception, with the S&P 500 hitting a low on October 13th, 2005 and reached its 2006 intraday peak on May 8th. Imagine mutual funds receiving inflows in conjunction with the rise in the market and since most equity mutual funds trade in and out of positions frequently they may realize a large amount of capital gains in the first 6 months of the fiscal year (November-April).

After the market trails off in the summer months (as it did this year) they realize that many investors that purchased shares near the peak now have losses on their position yet will be required to receive a capital gains distribution from the fund. A related point is that funds don't like to make distributions, preferring to keep the asset base intact for fee generation. Bottom line: fund managers spend much of September digging through their portfolios looking for losses to offset earlier gains. Because they tend to think well in advance on this (unlike individual investors who may wait until Christmas hoping their losers turn around), the fund managers are generally finished culling portfolios by early October and the market can be free to run up again. This was not as much of a factor in 2003 or 2004 due to the tax-loss carryforwards in the funds from 2000-2002 but should be more of a factor going forward.

There are a lot of reasons for this. We think one of the main reasons is that most mutual fund's fiscal years end at the end of October. The stock market often trades in a seasonal pattern where the best returns occur from mid/late October through April of the following year. The past year was no exception, with the S&P 500 hitting a low on October 13th, 2005 and reached its 2006 intraday peak on May 8th. Imagine mutual funds receiving inflows in conjunction with the rise in the market and since most equity mutual funds trade in and out of positions frequently they may realize a large amount of capital gains in the first 6 months of the fiscal year (November-April).

After the market trails off in the summer months (as it did this year) they realize that many investors that purchased shares near the peak now have losses on their position yet will be required to receive a capital gains distribution from the fund. A related point is that funds don't like to make distributions, preferring to keep the asset base intact for fee generation. Bottom line: fund managers spend much of September digging through their portfolios looking for losses to offset earlier gains. Because they tend to think well in advance on this (unlike individual investors who may wait until Christmas hoping their losers turn around), the fund managers are generally finished culling portfolios by early October and the market can be free to run up again. This was not as much of a factor in 2003 or 2004 due to the tax-loss carryforwards in the funds from 2000-2002 but should be more of a factor going forward.

0 Comments:

Post a Comment

<< Home