Optimism Index Fades

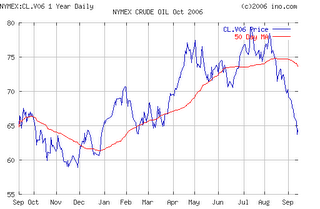

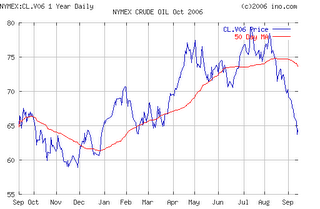

The National Federation of Independent Business (NFIB) Index declined from 98.1 to 95.9, which is consistent with GDP growth around 1%. The net percent expecting higher sales fell to 10% from 18%. After making a double peak in July/August near $80 per barrel, crude oil prices appear to be making a short-term bottom at late winter support levels around $64. We think a bounce is likely here but would not be surprised to eventually reach the 4Q05 support level below $60.

Strategy Update: We bottom-fished a few names in the energy and materials sectors in the Dynamic Beta Strategy, but continue to be cautious on the overall market. We would note that this is options expiration week. In most months this year, the trend of options expiration week seems to be reversed the following week.

Strategy Update: We bottom-fished a few names in the energy and materials sectors in the Dynamic Beta Strategy, but continue to be cautious on the overall market. We would note that this is options expiration week. In most months this year, the trend of options expiration week seems to be reversed the following week.

0 Comments:

Post a Comment

<< Home