Richard Russell, the long-time writer of the

Dow Theory Letters recently commented on the large divergence of opinion regarding the current state of the markets. He mentions several: "David Fuller writes, 'we have often said that Wall Street is in a secular bear market, which we define as a generational long period of P/E ratio contraction and rising dividend yields. The path that a bear market follows is dictated by the availability of liquidity. A Japanese style deflation has been averted because the Greenspan Fed eased aggressively and allowed the monetary base to expand. Barring a major central bank monetary policy blunder we can expect Wall Street's uptrend to continue. James Paulsen, a successful investment strategist is basically bullish although he believes somewhere ahead the dollar must fall . . . Noriel Roubini almost guarantees that the US is headed for a major recession that will hit in 2007 . . . Martin Barnes of the

Bank Credit Analyst believes that 'the US economy remains on track for a housing and consumer-led mid-cycle slowdown' . . . but 'the grinding equity bull market should continue. Valuations are decent and market multiples should expand when it is clear that the Fed has finished tightening' . . . [yet] fund manager

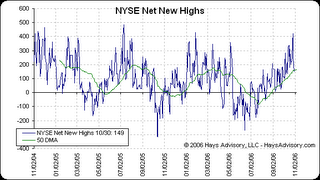

John Hussman writes: 'The current Market Climate in stocks is characterized by unfavorable valuations, but modestly favorable market action. Valuations are sufficiently high that we can already conclude that total returns on the S&P 500 over the coming 5-7 years will probably fall short of Treasury bill yields. The current bull market has already lasted beyond the historical norm, and though the S&P 500's percentage gains of the past several years haven't been spectacular from a historical perspective, this has been among the longest periods the market has ever gone without a 10% correction' . . . Lowry's thinks that what we're seeing now is an extension of the bull market that began at the 2002 lows."

As for Russell, he asks, "where's the decline associated with the 'six bad months' of May to October?" He also notes the market's current "remarkable complacency . . . Volatility, now below 11, is near a record low, this in the face of a failing war, huge deficits, and the possibility of a housing slide."

We believe the stock market is both overbought and overvalued yet find ourselves mostly content to earn profits as long as Hussman's "favorable market action" continues.

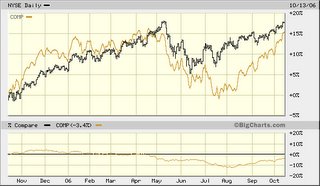

Strategy Comment: Month-to-date we have 7 strategies up 5%-10% (the Focused Analyst Growth strategy up 10% MTD and over 21% year-to-date). We find this to be incredible, particularly since the market never had the usual September/October correction. Our increasingly plausible rationale for this is the greater influence on the markets of trend following hedge funds. This makes it important to not be contrarian too early nor too anxious to exit profitable positions. It also increases the importance of analyzing inflection points.

Aggregate Bond index of about 3% (see chart). The strategy's main focus is to profit from movements in the discount to NAV of closed-end bond funds. We continue to take profits in this sector and move to US treasury ETFs, now currently at about 50% of the strategy. For more information on strategies management, visit our website.

Aggregate Bond index of about 3% (see chart). The strategy's main focus is to profit from movements in the discount to NAV of closed-end bond funds. We continue to take profits in this sector and move to US treasury ETFs, now currently at about 50% of the strategy. For more information on strategies management, visit our website.