Baltic Dry Index

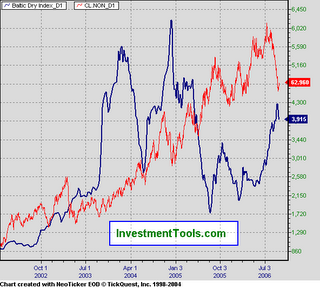

The Baltic Dry Freight Index have risen substantially in the past several quarters (see chart). Charlie Maxwell, the highly-regarded energy analyst at Weeden & Co. has often said this, along with a rise in Tanker rates, has been a harbinger of higher crude prices in the past.

In recent years China has altered this relationship. In the Capital Chronicle , written from Grenoble, France by RH Adams they ask if this is still a good proxy for global economic activity. They state, "As China moves in 2006 to being a consistent net exporter of steel its influence over an important driver of the Baltic Dry Index (BDI) - iron ore for steel production - grows. But China's massive growth in steel output has come in large part though government intervention. This, to some degree, is distorting the underlying freight rate picture. . ."

"China's imports of iron ore represented 13% of total dry bulk trade in 2005. Given that in the half year 2006 Chinese iron ore imports jumped 23% that share has at least held steady and probably risen. Chinese steel production has correspondingly accelerated. To June 2006 it churned out 35% of global output and has become a consistent net exporter of steel since the start of the year. Which is essentially the same time period over which the BDI has counterintuitively taken flight. . . China is in effect artificially boosting freight rates on an unprecedented scale (by having become the largest iron ore consumer and steel producer)."

This should sort itself out over the next several quarters with the BDI declining from recent peaks. In the meantime, we think a contratrend rally in crude is likely from these levels as we enter the fall season. Global economic slowing had a hand in the recent decline, but we suspect hedge fund capitulation and over-leverage contributed, as well.

Strategy Update: The stock market has entered one of those occasional odd periods where certain sectors have had radically different performance. Technology stocks are overbought and energy and material stocks are at oversold levels, reversing what was the case in July (when stocks like NVDA, ADBE and AMD couldn't seem to find a bottom). Our strategy managers have taken the opportunity to increase positions in energy and materials in several strategies, including Dynamic Beta and Equity Opportunity. Commodity exposure has increased in Dynamic Commodity and Dynamic Global Macro. For more information on Strategy Investing with up to 10 strategies per account, visit www.windriveradvisors.com/strategies.

In recent years China has altered this relationship. In the Capital Chronicle , written from Grenoble, France by RH Adams they ask if this is still a good proxy for global economic activity. They state, "As China moves in 2006 to being a consistent net exporter of steel its influence over an important driver of the Baltic Dry Index (BDI) - iron ore for steel production - grows. But China's massive growth in steel output has come in large part though government intervention. This, to some degree, is distorting the underlying freight rate picture. . ."

"China's imports of iron ore represented 13% of total dry bulk trade in 2005. Given that in the half year 2006 Chinese iron ore imports jumped 23% that share has at least held steady and probably risen. Chinese steel production has correspondingly accelerated. To June 2006 it churned out 35% of global output and has become a consistent net exporter of steel since the start of the year. Which is essentially the same time period over which the BDI has counterintuitively taken flight. . . China is in effect artificially boosting freight rates on an unprecedented scale (by having become the largest iron ore consumer and steel producer)."

This should sort itself out over the next several quarters with the BDI declining from recent peaks. In the meantime, we think a contratrend rally in crude is likely from these levels as we enter the fall season. Global economic slowing had a hand in the recent decline, but we suspect hedge fund capitulation and over-leverage contributed, as well.

Strategy Update: The stock market has entered one of those occasional odd periods where certain sectors have had radically different performance. Technology stocks are overbought and energy and material stocks are at oversold levels, reversing what was the case in July (when stocks like NVDA, ADBE and AMD couldn't seem to find a bottom). Our strategy managers have taken the opportunity to increase positions in energy and materials in several strategies, including Dynamic Beta and Equity Opportunity. Commodity exposure has increased in Dynamic Commodity and Dynamic Global Macro. For more information on Strategy Investing with up to 10 strategies per account, visit www.windriveradvisors.com/strategies.

0 Comments:

Post a Comment

<< Home