High Yield Investing

Investors in corporate high yield often simply compare the total income from a high yield investment to total income from other investments. By definition, high yield usually compares favorably. We think it warrants more attention than this and find that analyzing a variety of factors can improve total return considerably. In taxable fixed income, high yield bonds are debt obligations of below investment grade corporations. Typical issuers include General Motors Acceptance Corp., Sprint Capital, Lucent Technologies, Quest, Rogers Wireless, Boyd Gaming, AES Corp., and Williams Cos., etc. Historically, some of these companies disappear and as a result, the total return (principal plus interest) is often less than the amount of income generated. As such, it is critical to evaluate is the credit spread, or the amount of interest generated relative to a risk-free investment (US treasuries), to determine if you are being adequately compensated for the extra risk. If the additional income is too small it does not provide a good risk/reward profile and it makes sense to step aside. Generally credit spreads are narrow when few defaults have surfaced in a moderate to low interest rate environment. Under these conditions, investors chase yield and bid up the prices of high yield bonds to unreasonable levels. In recent years hedge funds have been a factor, as well. They leverage up their funds through borrowed money from Japan and other places and purchase high yield securities. This leverage swings both ways and has exacerbated trends in high yield.

Another consideration is the projected direction of interest rates. Rising interest rates are usually a response to a strong economy and anxiety over future inflation rates and result in declining bond prices.

Our high yield strategy has made extensive use of closed-end bond funds. This adds another component to returns - the discount to Net Asset Value. In closed-end funds this variation from NAV can swing from a premium to a sizable discount. As can be expected, this discount is often the widest in times of stress (rising interest rates and increasing defaults) creating contrarian opportunities for opportunistic investors. Spreads can swing from 10-20% discounts to premiums and then back to discounts over time.

Simply comparing income misses much of the profit opportunity.

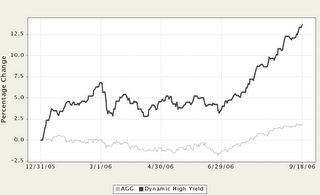

Strategy Update: Our Dynamic High Yield Strategy has had solid performance YTD, up 13.72% and significantly over the Lehman Aggregate Bond Index, seen here up 1.77%. Discount to NAV continues to be wider than normal on funds held in the strategy yet narrower by 4-5% versus earlier in the year. Combined with the recent moderate decline in interest rates we have chosen to take a bit off the table and are now at 32% in the Lehman 1-3 year treasury exchange traded fund. Should either rates decline more (as we expect) or spread to NAV narrow more we would anticipate further profit-taking.

Another consideration is the projected direction of interest rates. Rising interest rates are usually a response to a strong economy and anxiety over future inflation rates and result in declining bond prices.

Our high yield strategy has made extensive use of closed-end bond funds. This adds another component to returns - the discount to Net Asset Value. In closed-end funds this variation from NAV can swing from a premium to a sizable discount. As can be expected, this discount is often the widest in times of stress (rising interest rates and increasing defaults) creating contrarian opportunities for opportunistic investors. Spreads can swing from 10-20% discounts to premiums and then back to discounts over time.

Simply comparing income misses much of the profit opportunity.

Strategy Update: Our Dynamic High Yield Strategy has had solid performance YTD, up 13.72% and significantly over the Lehman Aggregate Bond Index, seen here up 1.77%. Discount to NAV continues to be wider than normal on funds held in the strategy yet narrower by 4-5% versus earlier in the year. Combined with the recent moderate decline in interest rates we have chosen to take a bit off the table and are now at 32% in the Lehman 1-3 year treasury exchange traded fund. Should either rates decline more (as we expect) or spread to NAV narrow more we would anticipate further profit-taking.

0 Comments:

Post a Comment

<< Home