A recent research publication from

Crestmont Research, reprinted in

Mauldin's E-Letter (see 11/20/06 Outside the Box archive), a detailed analysis of future stock returns provides a good baseline for understanding what challenges investors face in overcoming a long-term lackluster market.

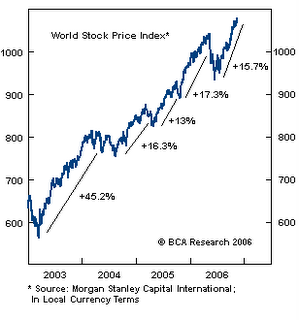

Assuming heady assumptions on ending earnings per share ($116) and P/E ratios (23) they project annual returns of 6.9% through 2016 (from a 1375 base in the S&P 500 Index versus today's close of 1406). This does not include dividends, so figure 8.9% with dividends. If the P/E ratio fades to 15 times in 2016, the average return is 2.4%. They also make a case for earnings of $81 in 2016 which means an annual return of 3.1% at 23x PE and -1.2% at 15x PE. Of course, if PE's revert to levels seen in prior bear markets of 10x, the annual return could be between -5.2% and -1.7%.

Cash isn't Trash: As they point out in the article, about the only way to exceed these returns is to focus on absolute return strategies. Some time ago we realized a couple of things about absolute return strategies:

First, it only takes a compounded return of 1.17% per month to reach an annual return of 15%. If you assume that, on average, half your portfolio was invested in cash equivalent earning 4.5% with the rest of the portfolio invested in stocks paying dividends of 1.5%, your average return from income would 3.0%, or 0.25% compounded monthly.

Second, subtracting 0.25% from the goal of 1.17% leaves 0.92% per month needed from appreciation to make the 15% annual return. There are several ways to get to a 0.92% monthly return: One could put 10% of the portfolio in an investment that rises 9.2% over the course of a month. Or maybe put 50% in a few securities that experience an average appreciation of 1.84%. Or maybe for a short period of time place the entire portfolio in securities that appreciate an average of 0.92%. This is the equivalent of riding a stock from $27 to 27.25!

What can we learn from this?

Cash isn't trash if you invest in the right securities

when opportunities are present! Even with a large-cap index like the S&P 500 there are multiple opportunities to make 5-15% every year. So why don't more investors invest this way? We can think of several reasons: First, the advisory business tells investors to stick with the mutual funds they're currently invested in (if they don't own the funds, the funds can't earn the management fee). Second, they chase fund performance; a "cash isn't trash" investment philosophy usually requires a bit of contrarian resolve (going against the herd) that sometimes means you are on the sidelines watching as markets continue to rise. Third, they don't understand the impact of negative returns and the importance of avoiding them: let's say you wish to average 15% per year over a 3-year period for a total compounded return of 52%. If you lose 15% in the initial year it will require nearly 34% in each of the next 2 years to capture the average return of 15% - not an easy task. Finally, they just don't have the time, experience or interest in pursuing this approach. A "swing only at fat pitches" philosophy requires some on-going decision-making. Take a look at some of our

strategies that utilize some of these philosophies.