Inflation Notes

"I guess we all could get upset by that gargantuan price gain for finished goods and for the core in the PPI. Frankly, I prefer to look at the changes from a year ago. Thus, the 2% monthly gain in finished goods is only 0.9% for the year. That 1.3% surge in the core is only 1.8% over the year. Of course, we should not talk so lightly about producer prices, but who seriously believes that SUV prices plunged 9.7% last month only to surge 13.7% this month. I even doubt that they are up the 0.7% from the previous year that the tables indicate. Certainly, a 2.2% gain in passenger car prices is suspicious when it follows a 2.3% drop the previous month. I certainly am not going to get upset by the surge in vehicle prices, which I doubt you will discover at the dealer's."

"Even with a near doubling of natural gas prices for the month (reflecting the unwinding of large hedge bets by one trader), they are down 35% from the previous year. . . Metal prices have reversed [gains] in recent weeks. Indeed, while my leading inflation indicators increased modestly in November, they already appear to be falling in December."

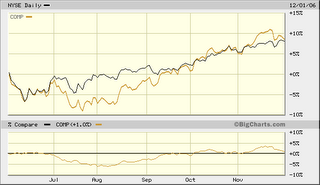

We would suggest that the interest rate markets also make a strong case for moderating inflation. A significant number of economists and investment strategists got burned throughout 2006 with their repetitive and wrong forecasts of rising intermediate/long-term interest rates.