Dollar Bounce

While everyone discusses why the dollar should decline it has managed to put in a quiet bottom since the mid-May interest rate peak in longer maturity bonds. There has also been a series of rising bottoms over this time period and it has the potential to breakout of a triangle formation to the upside. We continue to feel the consensus is too complacent about dollar weakness and think it could continue to surprise by climbing higher.

Why? As we pointed out in an earlier post, with the US economy rapidly slowing, the US consumer has greater incentive to temper spending and increase saving. This leaves goods suppliers, such as China, short the dollars needed to import oil, basic materials and technology products that are often priced in US dollars.

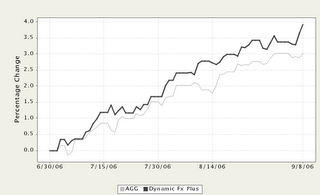

Strategy Update: The Dynamic Fx Plus Strategy continues to be long the US dollar with a portion of the portfolio. Performance has benefited from strong bond momentum and a moderately rising dollar. As can be seen from the following chart, Dynamic Fx has had nearly a 1% advantage over the Lehman Aggregate Bond Index since the end of June.

Why? As we pointed out in an earlier post, with the US economy rapidly slowing, the US consumer has greater incentive to temper spending and increase saving. This leaves goods suppliers, such as China, short the dollars needed to import oil, basic materials and technology products that are often priced in US dollars.

Strategy Update: The Dynamic Fx Plus Strategy continues to be long the US dollar with a portion of the portfolio. Performance has benefited from strong bond momentum and a moderately rising dollar. As can be seen from the following chart, Dynamic Fx has had nearly a 1% advantage over the Lehman Aggregate Bond Index since the end of June.

0 Comments:

Post a Comment

<< Home