Energy Sell-Off

The UBS energy team suggests there was a "perfect storm" responsible for the $17/bbl drop in the oil price since August:

1) "the U.N. failing to press Iran with sanctions following the Aug 31 deadline passing without the country committing to halt nuclear enrichment programs;

2) "the 38% collapse in gasoline prices (since late July) from the combination

of the liquidation of the contract by the Goldman Sachs Commodity Index

(GSCI), onset of more plentiful winter grade gasoline, and the seasonal

downturn in demand;

3) "the flurry of hurricane downgrade forecasts post-Labor Day removing a

significant supply risk; and

4) the somewhat normal decline in prices on a seasonal basis.

We would add short-covering and a fading world economy to the list of reasons.

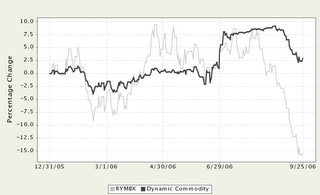

Strategy Update: Our Dynamic Commodity Strategy didn't entirely side-step the decline in commodity prices but has done much better year-to-date than commodity mutual funds, including the Rydex Commodity Fund, shown here versus our Dynamic Commodity Strategy:

The Dynamic Commodity Strategy is up 2.89% YTD versus a decline of 15.42% in Rydex for a positive performance spread of over 18.3 percentage points! Other than not being aggressive enough in the spring, we like how the year has played out in the Strategy. We stepped up our commodity exposure today and have only 20% remaining in short US treasury notes.

On the bond side, we pulled back maturities again in the Dynamic Duration Select Strategy and Core Fixed Income Strategies and now are closely invested to the intermediate-term benchmark. We still believe the economy is weakening enough to warrant further interest rate declines but think it makes sense to ease back on duration in the face of this short-covering rally. Performance of Dynamic Duration Select since the May 12 peak in rates has significantly exceeded the Lehman Aggregate Bond Index (AGG), 10.50% versus 4.40% for a plus 6.1% margin.

1) "the U.N. failing to press Iran with sanctions following the Aug 31 deadline passing without the country committing to halt nuclear enrichment programs;

2) "the 38% collapse in gasoline prices (since late July) from the combination

of the liquidation of the contract by the Goldman Sachs Commodity Index

(GSCI), onset of more plentiful winter grade gasoline, and the seasonal

downturn in demand;

3) "the flurry of hurricane downgrade forecasts post-Labor Day removing a

significant supply risk; and

4) the somewhat normal decline in prices on a seasonal basis.

We would add short-covering and a fading world economy to the list of reasons.

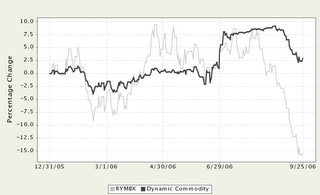

Strategy Update: Our Dynamic Commodity Strategy didn't entirely side-step the decline in commodity prices but has done much better year-to-date than commodity mutual funds, including the Rydex Commodity Fund, shown here versus our Dynamic Commodity Strategy:

The Dynamic Commodity Strategy is up 2.89% YTD versus a decline of 15.42% in Rydex for a positive performance spread of over 18.3 percentage points! Other than not being aggressive enough in the spring, we like how the year has played out in the Strategy. We stepped up our commodity exposure today and have only 20% remaining in short US treasury notes.

On the bond side, we pulled back maturities again in the Dynamic Duration Select Strategy and Core Fixed Income Strategies and now are closely invested to the intermediate-term benchmark. We still believe the economy is weakening enough to warrant further interest rate declines but think it makes sense to ease back on duration in the face of this short-covering rally. Performance of Dynamic Duration Select since the May 12 peak in rates has significantly exceeded the Lehman Aggregate Bond Index (AGG), 10.50% versus 4.40% for a plus 6.1% margin.

0 Comments:

Post a Comment

<< Home