Vacant Housing Inventory For Sale on the Rise

In an interesting development, UBS reports that in the third quarter vacant housing units for sale have surged to new highs, at over 1.5% of total housing stock (the 36 year low was approximately 0.5% in 1970). Vacant housing for sale plus new single-family homes for sale under construction as a percentage of total housing stock has increased to nearly 1.8%. The prior peaks in 1984 and 1988 were at 1.3%. The 30-year low was in 1977 at just under 0.9%. Current dollar as well as real home prices are now falling. The rental equivalent price index has trended up lately, reflecting the move of former homeowners back to rental markets. Yet the rental vacancy rate is still a relatively high 9.9% nationally.

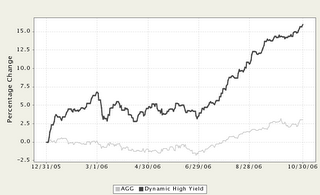

Strategy Update: The Dynamic High Yield Strategy is up over 16% year-to-date versus the Lehman Aggregate Bond index of about 3% (see chart). The strategy's main focus is to profit from movements in the discount to NAV of closed-end bond funds. We continue to take profits in this sector and move to US treasury ETFs, now currently at about 50% of the strategy. For more information on strategies management, visit our website.

Aggregate Bond index of about 3% (see chart). The strategy's main focus is to profit from movements in the discount to NAV of closed-end bond funds. We continue to take profits in this sector and move to US treasury ETFs, now currently at about 50% of the strategy. For more information on strategies management, visit our website.

Strategy Update: The Dynamic High Yield Strategy is up over 16% year-to-date versus the Lehman

Aggregate Bond index of about 3% (see chart). The strategy's main focus is to profit from movements in the discount to NAV of closed-end bond funds. We continue to take profits in this sector and move to US treasury ETFs, now currently at about 50% of the strategy. For more information on strategies management, visit our website.

Aggregate Bond index of about 3% (see chart). The strategy's main focus is to profit from movements in the discount to NAV of closed-end bond funds. We continue to take profits in this sector and move to US treasury ETFs, now currently at about 50% of the strategy. For more information on strategies management, visit our website.

0 Comments:

Post a Comment

<< Home