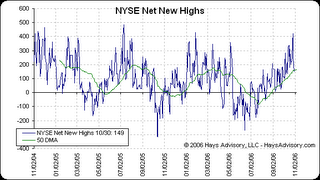

New Highs Rolling Over

Net new highs have rolled over recently as can be seen on this chart from Don Hays. This trend change is even more evident on the Nasdaq index. With the end of the quarter tomorrow, followed by elections next week we think this makes the case for some caution here.

Strategy Update: The Dynamic Beta Strategy has returned 22.0% since the bottom in June, well ahead of its balanced benchmark of 9.2% and the S&P 500 Index return of 13.3%. Today, we reduced equity exposure to 24% and may reduce further if the individual stock holdings show signs of tiring. Several of the remaining positions are gold related and have recently shown positive performance and inverse correlation to the equity market.

Strategy Update: The Dynamic Beta Strategy has returned 22.0% since the bottom in June, well ahead of its balanced benchmark of 9.2% and the S&P 500 Index return of 13.3%. Today, we reduced equity exposure to 24% and may reduce further if the individual stock holdings show signs of tiring. Several of the remaining positions are gold related and have recently shown positive performance and inverse correlation to the equity market.

0 Comments:

Post a Comment

<< Home