Nasdaq Relative Strength Update

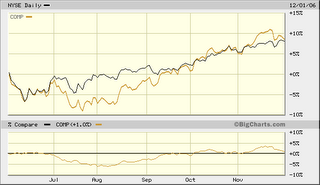

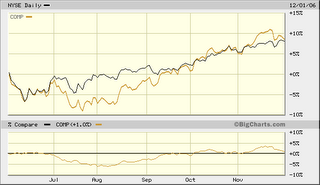

In an earlier post we mentioned one of our favorite intermediate-term indicators for the equity market: the relative strength of Nasdaq Composite versus NYSE Composite. As can be seen here, it turned up  in August and since then has seen higher highs and higher lows. But now the relative strength has faded for 10 days and is in danger of hitting a lower low, possibly resulting in a sell signal for this indicator.

in August and since then has seen higher highs and higher lows. But now the relative strength has faded for 10 days and is in danger of hitting a lower low, possibly resulting in a sell signal for this indicator.

We also note that individuals usually start hunting for tax losses about this time and continue selling small/mid-cap dogs into Christmas Eve. The last market day before Christmas this year is the 22nd. We've found that if you're thinking of buying small/mid-cap dogs on tax-loss selling the two trading days prior to Christmas generally offer the best prices. This year should be no different.

in August and since then has seen higher highs and higher lows. But now the relative strength has faded for 10 days and is in danger of hitting a lower low, possibly resulting in a sell signal for this indicator.

in August and since then has seen higher highs and higher lows. But now the relative strength has faded for 10 days and is in danger of hitting a lower low, possibly resulting in a sell signal for this indicator.We also note that individuals usually start hunting for tax losses about this time and continue selling small/mid-cap dogs into Christmas Eve. The last market day before Christmas this year is the 22nd. We've found that if you're thinking of buying small/mid-cap dogs on tax-loss selling the two trading days prior to Christmas generally offer the best prices. This year should be no different.

0 Comments:

Post a Comment

<< Home