Housing Sentiment and Inventories

Housing continues to weigh on the economy. Gary Shilling's recent article (see archive for 11/17) on housing that is reprinted in John Maldin's Weekly E-Letter is an interesting read.

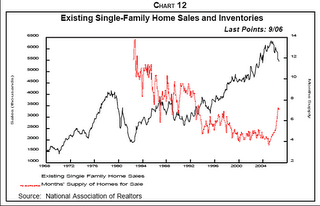

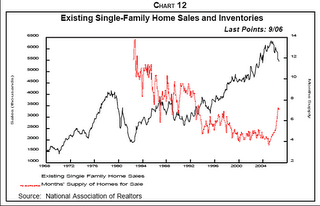

Of the many charts in the article, we think these two are the most interesting. The first shows how real consumer spending follows homebuilders' sentiment but typically with a small lag. The potential for a meaningful slowdown in consumer spending is real. The second chart shows that inventories of existing homes for sale have a long ways to go up before they approach earlier peaks. Shilling's conclusion is that the housing price decline will exceed 25% and hit bottom no sooner than the first quarter of 2008. That should make for an interesting political campaign, particularly if Iraq is off the radar screen.

Strategy Update: The Select REIT Strategy benefited from its ownership of Equity Office Properties Trust (EOP), which is up substantially (over 13% from month-end) on a takeover announcement. Dynamic Beta Strategy is currently at a minimal equity exposure after experiencing a rise of over 23% from the June low in the equity market.

Of the many charts in the article, we think these two are the most interesting. The first shows how real consumer spending follows homebuilders' sentiment but typically with a small lag. The potential for a meaningful slowdown in consumer spending is real. The second chart shows that inventories of existing homes for sale have a long ways to go up before they approach earlier peaks. Shilling's conclusion is that the housing price decline will exceed 25% and hit bottom no sooner than the first quarter of 2008. That should make for an interesting political campaign, particularly if Iraq is off the radar screen.

Strategy Update: The Select REIT Strategy benefited from its ownership of Equity Office Properties Trust (EOP), which is up substantially (over 13% from month-end) on a takeover announcement. Dynamic Beta Strategy is currently at a minimal equity exposure after experiencing a rise of over 23% from the June low in the equity market.

0 Comments:

Post a Comment

<< Home