Contrarian Commodity Note

A recent post by BCA Research mentions the structural demand support for oil: "Crude oil prices have fallen roughly 10% in the past month, reflecting plentiful crude inventories and warmer-than-usual weather in the northern hemisphere. We doubt there is sustainable downside from here. From a cyclical standpoint, the slowdown in the global economy should prove shallow and short-lived, so any demand softness will be limited. Longer-term, the emerging world’s thirst for oil will only increase. On the supply side, OPEC is trying to establish US$60 as a floor, and the lack of spare capacity among cartel members other than Saudi Arabia suggests it will ultimately succeed. Finally, while geopolitical strains are well known, they will keep oil price risks to the upside. Bottom line: we think the correction in oil prices is well advanced and look for prices to trend higher."

Seasonally, oil investments typically do well from February through late Spring as expectations begin to build for the summer driving and air conditioning demand. We view the current lull in pricing as a solid contrarian entry point.

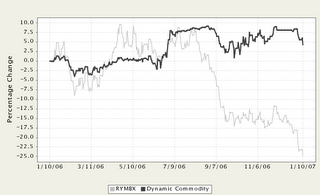

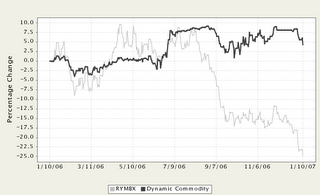

Strategy Update: our Dynamic Commodity Strategy has dramatically outperformed the Rydex Commodity Fund over the past year at much lower volatility (see chart). Part of the reason for this is our flexibility to adjust absolute commodity exposure. We are now fully invested in commodity ETFs in this strategy. With equity markets at highs, interest rates range bound and specialty areas such as REITs overbought, we view commodities as an emerging attractive investment for the next several quarters.

Strategy Update: our Dynamic Commodity Strategy has dramatically outperformed the Rydex Commodity Fund over the past year at much lower volatility (see chart). Part of the reason for this is our flexibility to adjust absolute commodity exposure. We are now fully invested in commodity ETFs in this strategy. With equity markets at highs, interest rates range bound and specialty areas such as REITs overbought, we view commodities as an emerging attractive investment for the next several quarters.

Seasonally, oil investments typically do well from February through late Spring as expectations begin to build for the summer driving and air conditioning demand. We view the current lull in pricing as a solid contrarian entry point.

Strategy Update: our Dynamic Commodity Strategy has dramatically outperformed the Rydex Commodity Fund over the past year at much lower volatility (see chart). Part of the reason for this is our flexibility to adjust absolute commodity exposure. We are now fully invested in commodity ETFs in this strategy. With equity markets at highs, interest rates range bound and specialty areas such as REITs overbought, we view commodities as an emerging attractive investment for the next several quarters.

Strategy Update: our Dynamic Commodity Strategy has dramatically outperformed the Rydex Commodity Fund over the past year at much lower volatility (see chart). Part of the reason for this is our flexibility to adjust absolute commodity exposure. We are now fully invested in commodity ETFs in this strategy. With equity markets at highs, interest rates range bound and specialty areas such as REITs overbought, we view commodities as an emerging attractive investment for the next several quarters.

0 Comments:

Post a Comment

<< Home